All About SWIFT Risk Assessment and Swift CSP

SWIFT Security Assessment

What is SWIFT security assessment?

SWIFT, or indeed the Society for Worldwide Interbank Financial Telecommunications, was established in 1973 as well as being a cooperative organization that connects over 11,000 institutions, financial firms, and enterprises from over 200 countries around the world. Its mission is to promote and build worldwide interactivity for monetary operations that is standardized. SWIFT introduced its Customer Security Program (CSP) in 2017 to strengthen the global banking system’s security while also assisting clients in their battle over cyber-fraud.

The SWIFT Client Security Controls Model requires all SWIFT customers to evaluate their SWIFT surrounding ecology (CSCF). Users must certify compliance with the CSCF every year after completing this self-assessment. SWIFT security assessment has been vigorously implementing the CSCF through inspections since January 2018, notifying non-compliant enterprises to their local supervisors. Even though SWIFT cannot apply penalties on firms, banks all around the globe have been meticulous in fining or otherwise punishing institutions for different forms of SWIFT violations.

SWIFT Customer Security Program (CSP)

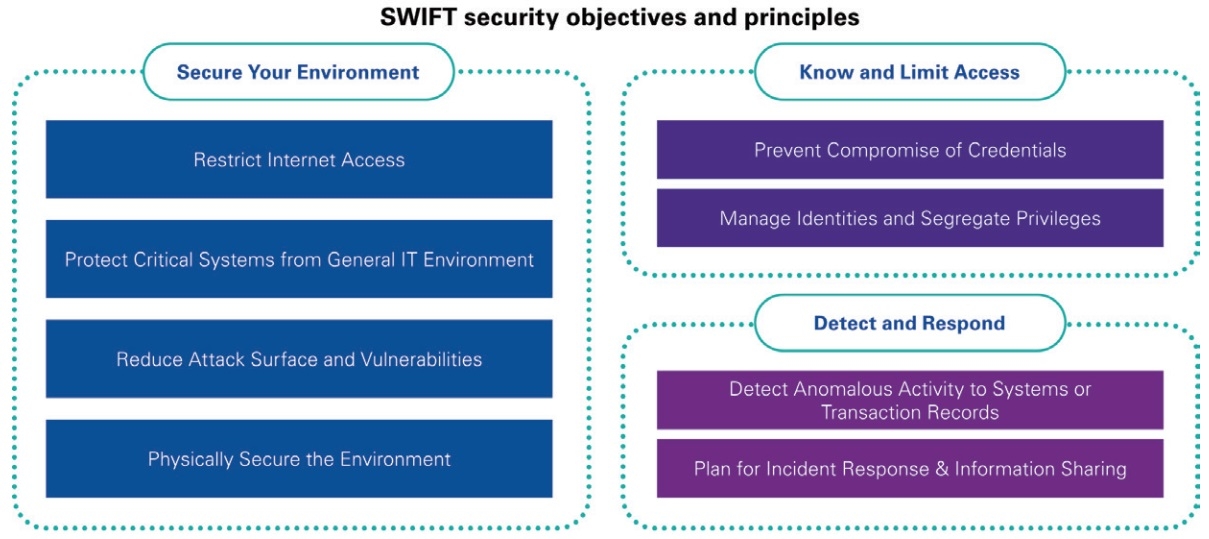

The SWIFT (CSP) intends to increase banking community information sharing. The CSP assists users in safeguarding and protecting their surrounding ecology initially, then in avoiding and identifying fraud in their business contacts, and finally in exchanging data and planning for future cyber-attacks. Every July, SWIFT security assessment releases an upgraded version of CSCF. The documentation should be used to prepare and finance for the coming year because it contains any changes to the foundation rules.

A collection of mandatory and recommended security rules for SWIFT users is described in the SWIFT Customer Security Controls Framework. Security rules that are obligatory for all consumers on their regional SWIFT infrastructure set a secure foundation for the community members. SWIFTsecurity assessment has prioritized these required measures to set a realistic objective for near-term, measurable security gains and risk minimization. SWIFT advises that customers utilize advisory controls since they are based on best practices.

So, owing to the changing threat landscape, obligatory controls may alter over a term, and some advised measures could become compulsory. Cyber threats on international financial institutions are still a concern. The CSCF v2021 has 22 obligatory controls and 9 optional controls. The SWIFT security assessment has set obligatory client security rules to establish a security baseline for the whole sector as a consequence of a series of targeted attacks in previous years.