What Are the Four PCI DSS Compliance Levels for Businesses?

PCI DSS Compliance | 5.imimg.com

With most businesses doing financial transactions online, it is possible that data breaches may happen if not adequately protected. Any business enterprises, whether large, medium or small, are vulnerable to security breaches or cardholder theft. The credit card companies, to manage the payment card industry (PCI) security standards, lay down the PCI Data Security Standard (DSS) to mandate the security of debit or credit card transactions of processing, transmitting and storing of customer card details.

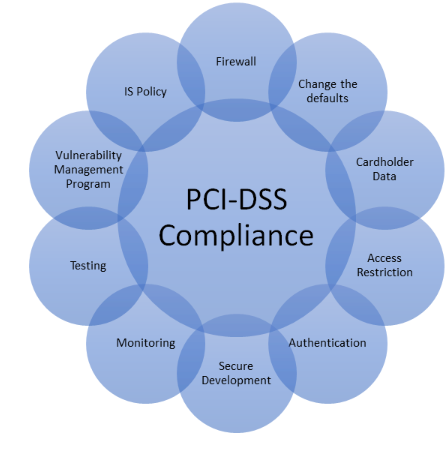

Being PCI DSS compliance means complying with the operational and technical standards by merchants and service providers to safeguard the cardholder information transmitted via card processing transactions. The security of card transaction processes of anyone like an enterprise, acquiring bank, service provider, financial institution, credit card processor, etc., is thus ensured to be PCI compliant.

Different PCI DSS Compliance Levels Explained

When it comes to card transactions, businesses process quite an amount of them every year. Your business’ PCI compliance depends on the level you fall in respect to the number of transactions done. ThePCI DSS compliance levelsare based on the number of annual credit card transactions and are divided into four:

Level 1: You fall under this level if your business processes more than six-million card transaction annually. The PCI DSS standards ask for an internal audit by the PCI auditor every year to be PCI compliant. With the help of an Approved Scanning Vendor (ASV), you should also file a PCI scan for the purpose.

Level 2: This level has businesses processing 1-6 million credit and debit card transactions yearly. In such a case, you have to file a duly filled in self-assessment questionnaire (SAQ) every year and also send a PCI scan once in every quarter.

Level 3: Where your business processes between 20000 and 1 million e-commerce transactions annually, you need to lodge not only a relevant SAQ every year but also a PCI scan every quarter.

Level 4: With businesses processing less than 20000 e-commerce transactions or those processing up to 1 million visa card transactions come under this level. They are also required to undergo annual assessment and submit the related SAQ and a PCI scan.

What Makes PCI DSS Compliance Essential for Business?

You are required to conform to PCI DSS compliancestandardsin case you are processing card transactions. The customer card data need to be protected for they are sensitive and prone to data breaches. The Security Standards Council (SSC), which controls and manages the PCI compliance hardly has any rights to force the compliance. Nonetheless, it is up to a business to win the thrust of its customers for continuing and lasting relationships.

Your PCI compliance goal can be attained via a supportable compliance program, including planning, using adequate tools, detailed documentation and monitoring. Meeting the requirements helps you have a PCI DSS compliance certification. The security compliance requirements however keep changing due to periodical updating. With the help of a Qualified Security Assessor (QSA), you can get your business assessed.